Financial Converters: Your Go-To Resource for Financial Calculators

Introduction : Financial calculators are specialized tools designed to assist individuals and businesses in making informed financial decisions. By providing computational capabilities tailored to various financial scenarios, these calculators help users analyze situations such as loans, savings, investments, and retirement planning. The primary purpose of a financial calculator is to streamline complex calculations, empowering users to evaluate different financial outcomes with ease and precision.

The significance of using financial calculators cannot be overstated, as they serve as essential financial tools. Whether a person is looking to buy a home or a business is planning its cash flow, having the right financial instruments at hand allows for a better understanding of potential costs and benefits. This level of insight can lead to more effective budgeting and investment strategies, ultimately guiding users toward their financial goals.

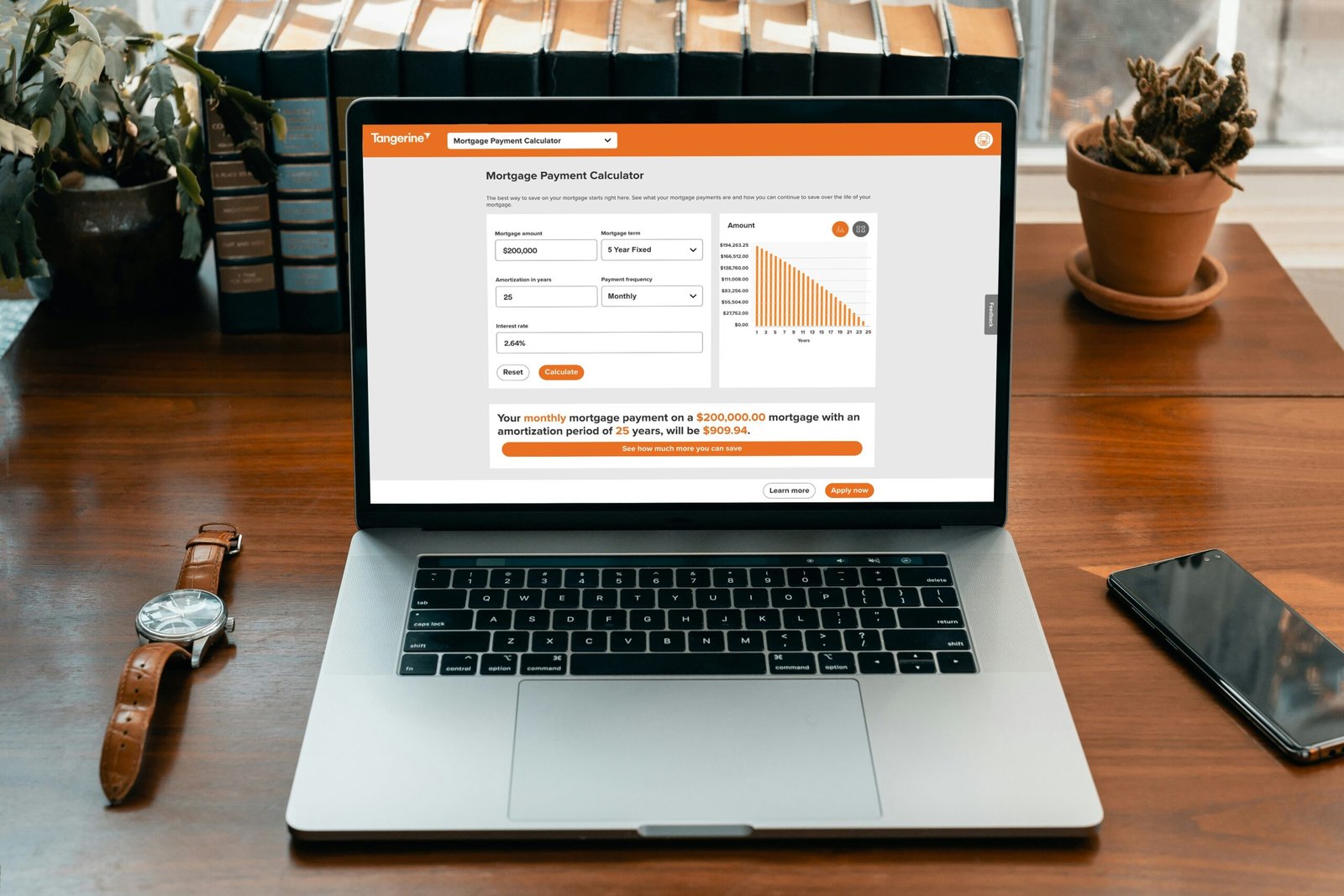

Moreover, financial calculators are designed to address specific finance-related queries. For instance, a loan calculator can help determine monthly payment amounts based on the loan amount, interest rate, and duration. On the other hand, an investment calculator can provide insights into how much a user might earn over time given certain contributions and interest rates. By utilizing these tools, individuals can simulate various financial scenarios, enhancing their ability to plan for the future.

In today’s financial landscape, where data-driven decisions are paramount, the role of financial calculators has become increasingly relevant. They not only aid in making numerical evaluations but also facilitate strategic planning by presenting different potential pathways and their associated risks or benefits. As we delve deeper into the specifics of various financial calculators in subsequent sections, it is crucial to recognize the foundational value these tools impart to the financial decision-making process.

Types of Financial Calculators Available

Financial Converters offers a diverse array of financial calculators designed to aid users in various aspects of financial planning and management. Each calculator is tailored to meet specific needs, ensuring that individuals and businesses can easily access the tools they require to make informed financial decisions.

The investment return calculator is a pivotal tool for investors, allowing users to estimate the potential returns on investments over a specified period. This calculator considers variables such as initial investment amount, expected rate of return, and duration, providing a clearer picture of future financial growth.

Additionally, the loan EMI calculator assists in calculating equated monthly installments for loans, helping borrowers understand their repayment commitments. By inputting the loan amount, interest rate, and tenure, users can quickly ascertain their monthly payments, facilitating better budgeting.

The loan interest calculator serves a similar purpose but focuses primarily on determining the total interest payable on a loan. This tool aids borrowers in understanding how much they will ultimately pay beyond the principal amount, enabling more informed loan choices.

An essential tool for those managing debt is the debt-to-income ratio calculator. This calculator provides a straightforward way to measure financial health by comparing an individual’s total monthly debt obligations to their gross monthly income, giving insight into the sustainability of their financial situation.

For straightforward borrowing scenarios, the simple interest calculator is invaluable. It calculates the interest accrued on a principal amount over a specified time period, making it easy for users to project future earnings or costs associated with simple interest loans.

Value-added tax and Goods and Services Tax calculations are simplified through the VAT/GST calculator. This tool assists businesses in computing the taxes due based on sales, ensuring compliance and accurate financial reporting.

Planning for retirement is crucial, and the retirement savings calculator evaluates how much one needs to save monthly to reach particular retirement goals. This estimate incorporates variables such as current savings, desired retirement age, and expected expenses.

For those seeking to maximize their savings potential, the compound interest calculator offers insights into the growth of investments over time, highlighting the benefits of reinvesting earnings to achieve exponential financial growth.

Lastly, the advanced financial calculator combines multiple functions to address complex financial calculations, making it a versatile tool for anyone engaged in detailed financial planning.

How to Use Financial Calculators Effectively

Financial calculators serve as essential tools for individuals and businesses alike, facilitating critical financial analysis and decision-making processes. To use these calculators effectively, it is crucial to gather the necessary data before beginning the calculation process. This includes precise financial figures such as income, expenses, interest rates, and time frames. Ensuring accuracy in the data collected not only enhances the reliability of the results but also minimizes the potential for errors, which can lead to misguided financial conclusions.

Understanding the specific inputs required for each financial calculator is also vital. Different calculators serve various purposes—ranging from loan payments and investment performance to retirement savings and budgeting. Therefore, familiarizing yourself with the types of inputs needed for the calculator in question will ensure that you are providing the right information. Many calculators will have specific fields to fill out, each corresponding to different financial variables. Take the time to read guidance or instructions provided to ensure you enter values correctly.

Interpreting the results generated by financial calculators can be equally complex. It is essential to have a foundational understanding of financial concepts to grasp the implications of the outputs. For instance, knowing what a positive return on investment means versus a negative one can significantly affect financial decisions. Additionally, it is advisable to validate the results produced by the calculator by cross-referencing with other financial resources or tools.

Common pitfalls to avoid include entering inaccurate data, misunderstanding financial terms, and neglecting to review the assumptions behind the calculations. By being vigilant and thorough during the data entry and interpretation phases, one can leverage the full potential of financial calculators, ultimately aiding in informed financial planning and management.

Real-Life Applications of Financial Calculators

Financial calculators serve a crucial role in various aspects of daily financial decision-making and long-term planning. One prominent application is in the area of monthly expense planning. Individuals often struggle to track their spending versus their income, making it challenging to achieve financial stability. By utilizing a budgeting calculator, users can input their monthly income and recurring expenses to determine how much they can allocate towards discretionary spending, savings, and investments. This simple yet effective tool creates a clearer picture of one’s financial health, enabling better control over finances.

Another significant application of financial calculators is retirement planning. With increasing life expectancies, individuals must carefully assess how much to save for retirement to maintain their desired standard of living. Retirement calculators allow users to input current savings, expected contributions, and potential investment growth rates. This information helps forecast the total amount available upon retirement, guiding decisions on when to retire and how to adjust savings strategies accordingly. Such tools simplify the complexities of retirement planning, ensuring individuals are better prepared for their financial futures.

Assessing loan options is also a common scenario where financial calculators prove invaluable. Whether it is for a mortgage, auto loan, or student loan, consumers can use these calculators to evaluate monthly payments based on different interest rates, loan amounts, and terms. This aids in comparing various loan products to determine which option aligns with their financial capabilities and objectives. Additionally, investment calculators can help users project potential returns on different investment strategies, facilitating informed decisions regarding asset allocation.

In summary, financial calculators are versatile tools that offer practical solutions for everyday financial challenges. They provide clarity in budgeting, retirement planning, loan assessment, and investment management, making them essential for anyone looking to achieve their financial goals efficiently. These calculators empower users with the information necessary to make informed decisions and ultimately pave the way toward financial success.